Over ten years ago, the venture capital ecosystem felt more like an evolving idea rather than a reliable growth factor. Even with progressive agencies and funding, much of the sector was shadowed by U.S. and Chinese influence.

Today, much of that investing environment has shifted. The most recent Invest Europe numbers signify a transition to a new era, marking over €143 billion invested in 26,000-plus startups, more than a million jobs, and cultivating a sense of optimism and excitement in many local industries.

At Zubr Capital, a European growth equity and private equity fund focused on scaling innovative businesses, we’ve watched with delight to see firsthand how the investing ecosystem is evolving. All the rapid growth has prompted a new question: what has changed over the past decade, and what will that mean for the future?

The maturing European VC market is due to improving numbers, shifting investor focus, and varying capital attraction, but that only tells a smart part of the total story. Many challenges and opportunities are ahead, making it essential to revisit the trends and momentum that got us here as well as where it might lead next.

Tracking a Decade of European Venture Capital Growth

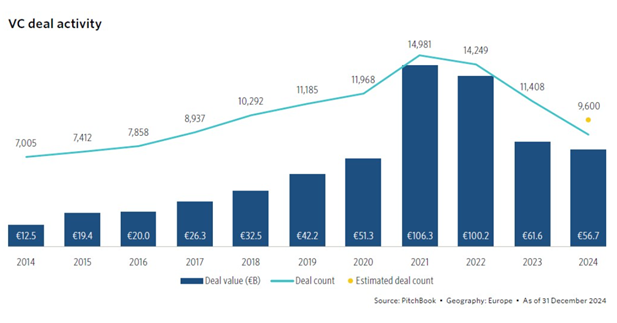

The past ten years have been kind to Europe’s VC landscape. It wasn’t that long ago in 2015 that startups pulled in around $15 billion in funding. That measurement surged to over $100 billion in 2021, mostly powered by end-stage mega deals and a growing wave of international capital. While the market has cooled to $45 billion in 2023, those figures are above pre-pandemic levels.

Source: PitchBook, 2024 Annual European Venture Report.

Startups across the region raised over $420 billion over the past decade. The EU’s share of global VC rose from about 14% in 2014 to peaking at 18% in 2021. Even with the U.S. market still eclipsing the current EU investment stage of 15% in early 2025, there is a stable carve-out that speaks of greater resilience, ushering in a new “normal” compared to what was unimaginable only a decade ago.

Where European VC is Investing the Most

While the numbers certainly tell a promising story for the future, that is only one factor to consider. There is also the question of where those funds are targeted. A short time ago, it was all about Fintech, but climate technologies and innovation are the sectors to watch today. That one sector represented 27% of total European VC investment in 2023, double what was allocated only two years prior. Battery innovation, hydrogen energy, and clean tech solutions are all captivating investors and breaking records.

AI is foundational to much of this growth. The 2023 AI-investment landscape took a slight turn for the worse, but rebounded to new levels only a year later. The mass adoption of generative AI and groundbreaking automation made a difference. It was reported that 78% of organizations utilize such AI-tech in 2024, up from 55% the year before. This growth is noted in flagship deals like Mistral AI in France and Aleph Alhpa in Germany.

Flagship deals such as Mistral AI in France and Aleph Alpha in Germany highlight how European players are attracting global attention in the AI race.

Health and biotech are also still in the mix. The EU has unique strengths in research and life sciences, which helped a great deal during the pandemic. Even traditional sectors like B2B software and SaaS are seeing funding slip as investors shift to deep tech and modern infrastructure. Europe has become a global leader in climate tech. It is building a strong argument for the top spot in AI and industrial innovation.

New Startup Hotspots: Mapping Europe’s Innovation Trends

The UK, France, and Germany, better known as the Big Three, were often the hub of activity for European startups. London was a target location and continues to be ground zero for a considerable share of VC funding. That reputation is changing. France’s VC ecosystem is rapidly making an impact, closing in on Germany in terms of supporting new company development.

Those bigger areas are not the only part of the story to watch. Innovation is spreading faster than most VCs realize. The Netherlands, Sweden, and Switzerland all have emerging startup ecosystems, with smaller countries like Estonia and Ireland producing more unicorns per capita than more traditional locations. Almost 30 EU members can point to at least one billion-dollar business, meaning innovation isn’t just narrowly focused on a few hotspots, but expanding and fueling a cultural and commerce renaissance.

What About Exits and IPOs in the Modern EU?

The recent surge in company creation also reshaped exits. The post-COVID era forced a rush in IPOs, acquisitions, and record deals. After the peak in 2021, things began to change. IPO markets cooled, sharply slowing in 2022, resulting in exit values dipping. Many companies postponed going public, choosing to “wait out” the storm and favoring mergers and acquisitions as more private funding rounds became available.

The slowdown stretched investor timelines and created a larger-than-anticipated backlog of mature companies primed for the subsequent rebound. Over one hundred EU tech firms are considered “IPO-ready,” and in a state of preparation for whatever might come next. Exits today are more about patience, disciplined M&A, and a growing feeling among experts that an IPO surge is only around the corner.

Even with past successes like Spotify (founded in Stockholm, Sweden) and Adyen (headquartered in Amsterdam) proving Europe can offer world-class listings, the market conditions have to be “just right” for IPO offerings.

Who’s Backing the Market: The Structure of Current VC

The role of public money is changing alongside Europe’s VC environment. It’s true that private investors still hold the lion's share of funding, but recent government-backed funds are making headway, becoming foundational to innovation. Initiatives like the European Investment Fund and national development banks are positively impacting the growth market, to the point that in 2023, roughly 40% of VC funding was sourced from government entities.

A recent European Commission report emphasizes the creation of a Capital Markets Union (CMU) to unlock greater access to domestic savings. Those could be channeled directly into evolving startups, easing the bottleneck of traditional and fragmented structures. It might take a decade or more for this to occur, but it promises greater availability of mixed funding to startups.

Government funding has stabilized the situation, even with some private investors stepping back. Early-stage startups can still find initial funding opportunities, and the conversation around the need for more capital from private institutions is heating up. The possibility of pension funds, insurance companies, and more shows promise, while public participation offers a unique advantage for startups to better weather uncertainty and maintain a European long-term vision.

The Future of Europe’s Next Stages in Venture Capital

The past decade has been marked by a series of expansions and changes crucial to maturing Europe’s VC market. Investor confidence remains high, holding strong even during disruptions from local and global pressures. Startup creation remains steady, especially in evolving areas like AI, deep tech, and climate tech.

The challenges are becoming clearer. The European market must build a more integrated market, drawing on deeper pools of public and private funding and turning scientific research into globally scalable businesses. While the last decade is clear evidence of Europe’s ambition and talent, the next phase will be built on the foundation already laid, and that future is optimistic.