Poland’s enticing investment environment is attracting global investors, highlighted by the European Bank for Reconstruction and Development (EBRD)’s significant regional operations. This article, by Zubr Capital experts, examines Poland's investment climate via EBRD’s strategies. EBRD’s record €1.3 billion investment showcases Poland's increasing prominence as an international investment hotspot.

Poland's Investment Horizon: Harnessing the Tech Wave and Other Booming Sectors

Poland's investment environment is increasingly appealing, as confirmed by the 2023 US Department of State reports. Even with challenges like high inflation and an energy crisis, its economy surpassed the EU's average by growing 4.9% in 2022.

Plenty of investment options are available in booming sectors like IT, energy, defense, and infrastructure. Poland's forward-thinking administration, attractive tax benefits, and the Polish Investment Zone prove its dedication to a robust business setting. Hence, Poland assures a consistent offering of rewarding investment opportunities.

Highlighting IT as a particularly thriving sector, Poland has seen an exponential increase in tech investments. A clear illustration of this upswing is Intel's landmark foreign direct investment of USD 4.6 billion – till date, the country's largest. This tech investment, based in Miękinia, near Wrocław, has the potential to revolutionize not just Poland's economy, but also reshape the tech landscape of Eastern Europe.

Poland's appeal as an investment destination lies in its steadily growing economy backed by significant foreign capital inflows, appealing tax reliefs, and a solid financial sector. These elements contribute to Poland's investor-friendly image. Moreover, the country's competent workforce continues to attract substantial investments, indicating a prosperous future in the tech sector.

Billion Euro Contributions: EBRD’s Robust Investment Journey in Poland

Poland is a top investment location for the European Bank for Reconstruction and Development (EBRD). 2023 saw EBRD invest an impressive €1.3 billion, making Poland their third biggest market. In total, the EBRD has invested nearly €14 billion in Poland through over 500 projects, primarily in the private sector.

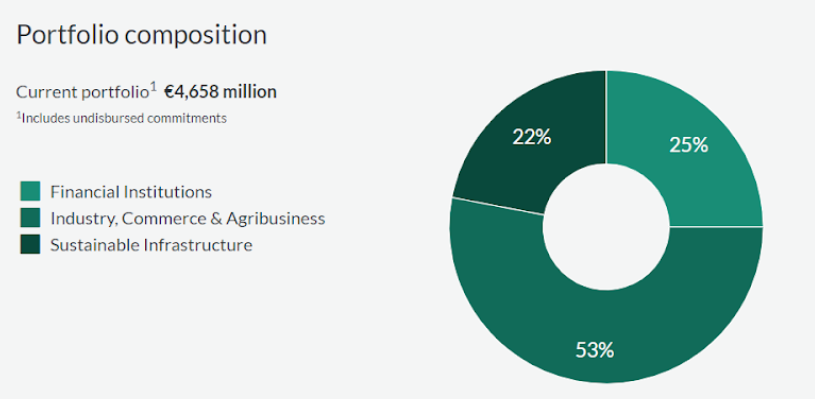

The EBRD's diversified strategy includes a 25% investment in financial institutions, with the remaining 75% split between industry, commerce, agribusiness, and sustainable infrastructure projects.

Source: www.ebrd.com

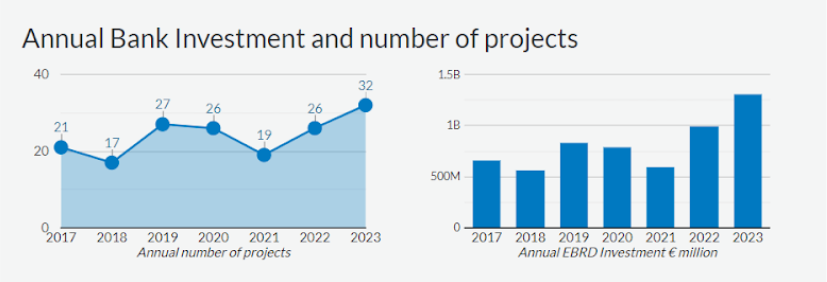

EBRD has steadily increased its investment in Poland, doubling the amount invested since 2017 to €1.3 billion in 2023. It supports green economies and private enterprises, particularly in manufacturing, renewable energy, and pharmaceutical sectors.

Source: www.ebrd.com

Major sectors of investment include Financial Institutions, Manufacturing and Services, and Environmental Infrastructure. The EBRD also shows a strong interest in sustainable resources and other sectors like Agribusiness, Transport, Property, and Tourism. This highlights the EBRD's comprehensive and diverse investment reach in Poland.

Addressing Challenges in Poland's Investment Environment: Insights from EBRD

EBRD tackles a variety of hurdles in Poland's investment scene. These obstacles range from business establishment to concerns over the enforcement of contracts. The power of regulatory frameworks to shape investment decisions is undeniable. Indeed, there are clear opportunities for improvement, such as helping medium-sized companies to extend their international presence, and devising new ways to fund businesses.

Furthermore, the urgency of diversifying the energy mix and improving energy efficiency is a necessity for combating pollution and steering the global shift towards a Green Economy. Enhancing governance in state-owned enterprises and elevating transparency and accountability levels are critical and cannot be emphasized enough.

From Concept to Concrete: Real-World EBRD Investment Examples

EBRD is gearing up its support for Polish industries. It's lending €90 million to Eko-Okna, a top contender in energy-efficient window and door production. This huge funding helps Eko-Okna build four more manufacturing plants and source half its energy from renewables, indirectly cutting carbon emissions in the construction sector.

Simultaneously, EBRD is assisting Poland's shift towards renewable energy. It allocated PLN 126.1 million (€29 million) for wind energy production, helping Eurowatt Green Energy Group's subsidiaries. Notably, the Grabkowo wind farm, a privately run project, is set to generate over 83 GWh of renewable energy annually, reducing 59,000 tonnes of CO2 emissions.

EBRD is injecting €25 million into the pharmaceutical sector by investing in the Pelion Group. This financial support bolsters Pelion's expansion in Poland, fueling the development of new products and digital services, such as telemedicine and e-commerce, aligning with EBRD's digitalization focus in the country.

Lastly, EBRD is promoting green finance by investing €20 million in Bank Pekao's first international green bond. This helps Bank Pekao pursue sustainable finance and fund green projects, underlining EBRD's commitment to boost Poland's green economy and sustainability efforts.

The Future of Global Investments: Poland's Strategic Appeal

Through a detailed analysis of EBRD's activities, this article has navigated Poland's dynamic investment landscape, unraveling the elements that make it a promising international hotspot. EBRD's considerable and diversified investments reflect Poland's strategic allure, offering a robust platform for potential investors. The EBRD’s substantial and strategic investments further emphasize Poland's significant role on the international investment stage. With the future harboring vast potential, Poland stands out as a thriving hub for investments.