In 2023, the European investment climate presented both challenges and promising opportunities. Particularly in the tech sector, which captured investors’ attention, there was robust support for innovation, digitalization, and sustainable growth. The European Investment Fund (EIF) played a pivotal role in this landscape, as evidenced by their comprehensive 2023 Annual Report.

Zubr Capital further examines the EIF’s report, considering their previous reports from 2019 and their operational plans for 2024-2026, with a specific focus on Innovation and Digitalization – the key areas of interest for the EIF.

Unraveling EIF's 2023 Financial Commitment to Digital Innovation

In the EIF Annual Report 2023, released on April 25, 2024, the European Investment Fund (EIF) demonstrated its continued commitment to fostering enterprise growth and development. The figures speak volumes: a total of €14.9 billion was deployed by the EIF, enabling access to €67.3 billion for small and medium-sized enterprises (SMEs) across the region, supporting over 350,000 businesses.

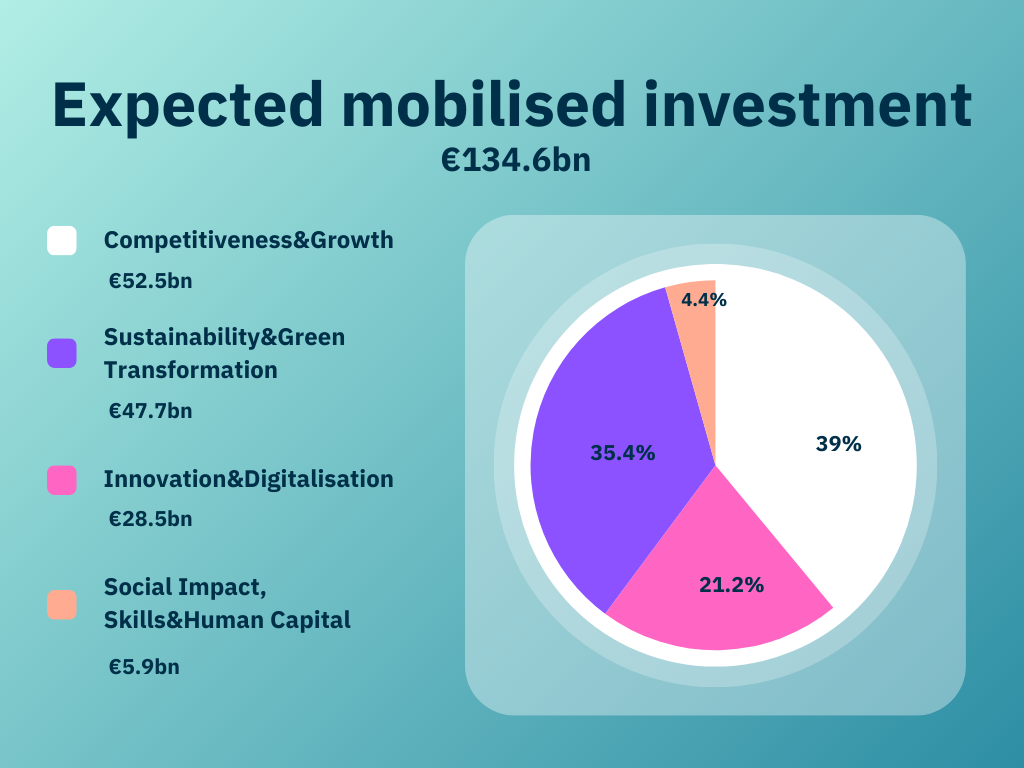

However, let’s delve deeper into the specifics. The broader economy felt the impact of these investments, with an expected mobilization of €134.6 billion. Here’s the breakdown: the Competitiveness & Growth sphere led the way with €52.5 billion, closely followed by Sustainability & Green Transformation, contributing €47.7 billion. Social Impact, Skills, and Human Capital also played significant roles, accounting for €5.9 billion.

Notably, Innovation and Digitalisation stood strong with a substantial investment of €28.5 billion. This sphere continues to be among the top three zones of curiosity for investors, highlighting the area's dedication to technology-based progression. As digital technologies continue to evolve and permeate various industries, they offer exciting opportunities for investors. It’s no wonder that innovation and digitalization claim an ever-growing slice of the investment pie.

Figure: Distribution of EIF Investments Across Economic Spheres in 2023

Source: based on the EIF 2023 Report

In summary, EIF’s strategic focus on digital transformation reflects a broader movement within the investment community, driven by the recognition of technology’s transformative power. The numbers tell a compelling story, but they also signal a forward-looking trend that aligns with the changing landscape of business and innovation.

Exploring the European Tech Investment Landscape: Insights from EIF’s Annual Reports

In the continually transforming terrain of innovation and digitalization, the European Investment Fund (EIF) serves as a guiding light, illuminating strategic areas of relevance for the European Union and its Member States. By delving into the EIF reports spanning 2019 to 2023, we uncover a dynamic tapestry of trends and shifts that have shaped the tech investment scene.

Steadfast Stars: The Tech Sectors in the Spotlight

Over the past half-decade, certain tech sectors have consistently basked in the EIF’s attention. These stars include artificial intelligence (AI), blockchain, language and machine learning, automation, data analytics, B2B software, the Internet of Things (IoT), Software as a Service (SaaS), cybersecurity, and fintech. Their enduring prominence underscores the EIF’s predictive prowess, as it strategically allocates resources to fuel their growth.

The Pandemic’s Ripple Effect: Health Tech and Life Sciences

The COVID-19 pandemic cast a long shadow over the European investment ecosystem. Amidst the uncertainty, health tech and life sciences emerged as beacons of relevance. Investors recognized their pivotal role in addressing global health challenges, and this focus persisted into 2023. These sectors became not just investment targets but also cornerstones of resilience.

New Horizons: European Strategic Autonomy and Emerging Trends

As Europe charts its course toward strategic autonomy, fresh trends have surfaced. In 2023, information and communication technology (ICT) and deep tech took center stage. The EIF’s substantial investments in these areas underscore their growing importance. Additionally, the once-obscure space industry now orbits as a critical component of Europe’s independent strategy, despite limited private sector participation.

A Transformative Journey: EIF Reports as Our Compass

From 2019 to 2023, the tech investment landscape transformed. Some sectors maintained their spotlight, while others burst forth as game-changers. As we navigate this dynamic terrain, the EIF reports remain our compass, guiding us toward strategic growth and development.

A Catalyst for Change: ETCI’s Role in Expanding Europe’s Tech Sector

The European Investment Fund has recently introduced an innovative endeavour, the European Tech Champions Initiative (ETCI). This thrilling project is a fitting expansion to the previously outlined scenario.

ETCI, launched in February 2023, has swiftly become a force to reckon with. As it celebrates its first anniversary, ETCI proudly boasts nearly €1 billion in investments – a remarkable achievement within its inaugural year.

ETCI’s mission is clear: to bolster Europe’s tech ecosystem by providing much-needed late-stage growth capital to promising innovators. Let’s delve into the impact of this groundbreaking initiative:

Funding Diversity: ETCI has strategically supported four funding schemes, each targeting different facets of the tech industry. Notably, it has poured resources into Atomico Growth VI, fostering collaboration with innovative tech entrepreneurs across Europe. Additionally, FSI II—a fund dedicated to medium-sized Italian businesses—has received backing. Keensight Nova VI, focusing on sectors like cybersecurity, automation, robotics, enterprise software, med tech, and healthcare services, has also benefited from ETCI’s investments.

Augmenting Impact: ETCI's objective is to enhance the breadth of Europe's growth capital markets by filling the funding voids, particularly for firms hunting for significant capital investments (exceeding €50 million). In pursuing this goal, it produces an investment category that permits European institutional investors to broaden their investment spectrum, guaranteeing an uninterrupted stream of capital to European businesses on the rise.

Ambitious Goals: The significance of the technology industry as an investment field cannot be overstated. ETCI’s vision extends beyond its initial success; it aspires to mobilize over €6 billion, fueling Europe’s digital evolution and supporting the expansion of its tech landscape. With strategic investments, ETCI molds the future of European tech leadership.

In summary, ETCI stands at the forefront of Europe’s tech revolution, propelling innovation, investment, and growth. As it enters its second year, the billion-euro milestone is just the beginning – a tribute to its dedication in sculpturing the digital future of the continent.

Boosting European Tech Investments: EIF's Forward-Thinking Strategy

In the face of uncertainty, the European Investment Fund (EIF) charts an ambitious course for the tech industry in Europe. Their Corporate Operational Plan for 2024-2026 outlines strategic targets, emphasizing both prudence and growth.

Steady Ambition

Despite challenging times, the EIF remains steadfast. Their goal is to maintain an activity level of EUR 14.0 billion in 2024. This pledge mirrors the careful strategy of EIF's administration, even in the face of escalating request for equity and debt offerings.

Funding Sources

InvestEU and Risk Capital Resources (RCR) continue as vital funding channels. InvestEU expands its reach, covering new domains like defense and security. Notably, the EIF benefits from increased budgets through resource redistribution within the Group and additional contributions from Norway and Iceland.

Tech Takes Center Stage

In 2024, stock market operations are poised to surpass the debt/guarantee sector, largely due to the European Tech Champions Initiative (ETCI). ETCI receives extra support and specialized co-investment tools, driving tech sector investment. EIF’s diversification efforts further fuel this momentum.

Tech Excellence

EIF’s unwavering support for tech enterprises underscores its faith in Europe’s digital and technological growth. The intensified focus on the tech sector elevates its importance across Europe’s investment landscape.

In summary, EIF’s strategic vision propels European tech investment forward, embracing challenges and opportunities alike.

Final Thoughts: Looking Ahead on Europe's Tech Investment Landscape

Within the ever-changing environment of European financial ventures, the EIF has been a critical player in determining the pathway of the technology industry. As we peer through the EIF’s lens, it becomes evident that the commitment to technology is not fleeting; rather, it’s a steadfast movement gaining momentum within the investment community. The ongoing digital revolution, spanning diverse industries, offers an exhilarating canvas for investors. Notably, the focus on tech sectors—AI, blockchain, automation, and cybersecurity—underscores their undeniable relevance. Concurrently, budding sectors such as Information and Communication Technology, profound technology, and the cosmic sector indicate Europe's tactical autonomy.

The initiation of the European Tech Champions Initiative (ETCI) stands as a beacon of promise. Supervised by the EIF, ETCI directs mature-phase developmental funds towards European pioneers, filling financing voids and strengthening Europe's strategic independence. With initial commitments from EU Member States, ETCI endeavors to cultivate domestically-rooted creativity, create jobs, and boost growth. As we celebrate ETCI’s one-year anniversary, it’s clear that Europe’s tech industry holds an optimistic future – one that resonates beyond tech, shaping the broader European economy through sustainable expansion and innovation.