While global venture markets are facing the consequences of macroeconomic challenges, the venture sector in Central Asia and Caucasus (CA&C) shows positive dynamics. The countries in the region, especially Kazakhstan, are reaching new levels thanks to government support and the increase in the number of venture funds.

The total amount of venture deals in the region exceeded $110 million in 2023. However, the ecosystem remains small, indicating significant potential for additional investments.

In terms of industries, in 2023, the greatest interest from venture investors in Kazakhstan was attracted by startups in FinTech, as well as AI, HealthTech, and PropTech (real estate technology).

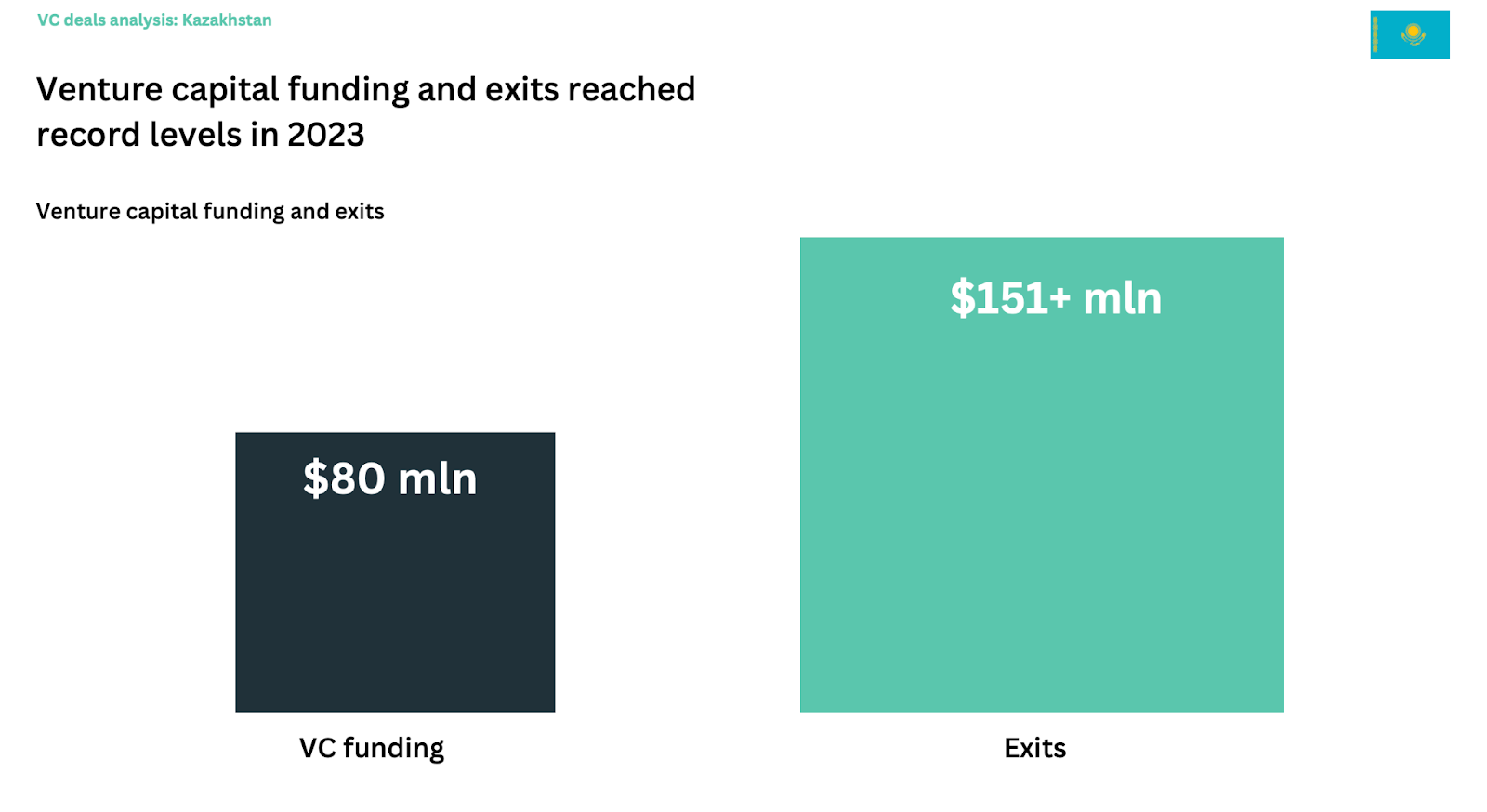

By 2023, the volume of venture deals in the CA (Central Asia) region reached a record $110 million, of which more than $80 million was accounted for by Kazakhstan.

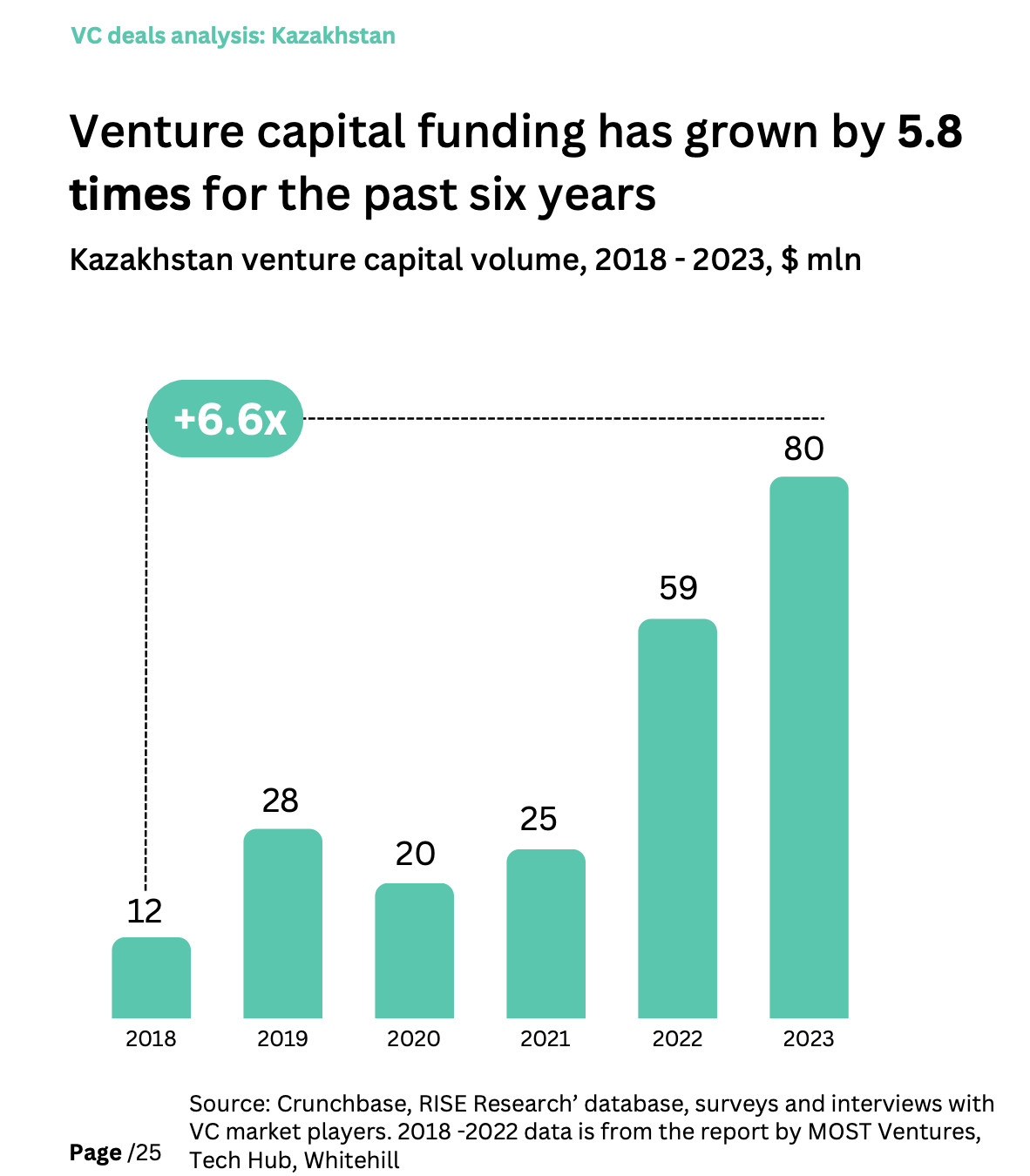

Venture investments over the last five years have grown 5.5 times, indicating a growing interest in early-stage startups and the willingness of local and international investors to invest in high-risk but potentially high-return projects.

The average size of venture deals in Kazakhstan has increased by 3.8 times over the past five years, reaching $265,000 by 2023. This growth is largely attributed to the active participation of government entities, such as the Ministry of Digital Development, Innovations, and Aerospace Industry of Kazakhstan, as well as private players like the Qazaqstan Investment Corporation.

The Richest Niche is Fintech

The sectors attracting the most interest from regional investors are IT, fintech, agrotechnology, logistics, and medtech.

In the IT sector, one of the most renowned Kazakh ventures is Chocofamily Holding. This umbrella company hosts several online services under the well-known brand names Chocofood, Chocotravel, and Chocomart. After securing over $38 million in investments, the creators successfully broadened their range of services.

Another successful Kazakh startup, Clockster, specializing in HR technology, has attracted significant investments for its development—a total of about $1.1 million. Interestingly, the startup's second office is located in Jakarta.

Startups in the fintech sector have attracted the most investment. The largest fintech company in Kazakhstan, Kaspi.kz, went public on the London Stock Exchange in 2020, raising around $1 billion and valuing the company at $6.5 billion. According to a Forbes journalist, it is the most valuable company in Kazakhstan's history. At the heart of Kaspi.kz's operations is its banking business, with its main product being a multifunctional payment system.

Wooppay is a prominent Kazakh fintech startup, established in 2011 in Karaganda. The company provides an e-wallet and a variety of payment services tailored to the Kazakh market.

Another thriving startup is AgroStream, which operates in the agricultural sector. AgroStream specializes in using drones and satellite data to monitor agricultural lands, offering farmers solutions to enhance crop yields.

Challenges and Prospects

Despite positive dynamics, the venture market in Central Asia faces several serious challenges such as a lack of capital and early investments, as well as limited scalability.

According to Crunchbase, local investors account for about 80% of deals in terms of numbers, but only 45% in terms of total investment volume. This means that scaling projects requires an influx of international capital.

While there are many investors in the region focusing on the seed stage, access to capital for startups at later stages of funding is limited. Many startups that have reached the growth stage face difficulties in attracting sufficient funding for further scaling.

In 2025, the region's venture market is expected to continue growing, with an increase in the number of deals and the attraction of new venture funds. Significant investments are anticipated in the fintech, agrotechnology, and healthcare sectors, which continue to lead in terms of funds raised.

Fast-growing sectors, government support, and the presence of promising startups make the region attractive to foreign funds. Investing in venture startups in Kazakhstan and other Central Asian countries can become a long-term strategy that ensures high returns on investments.